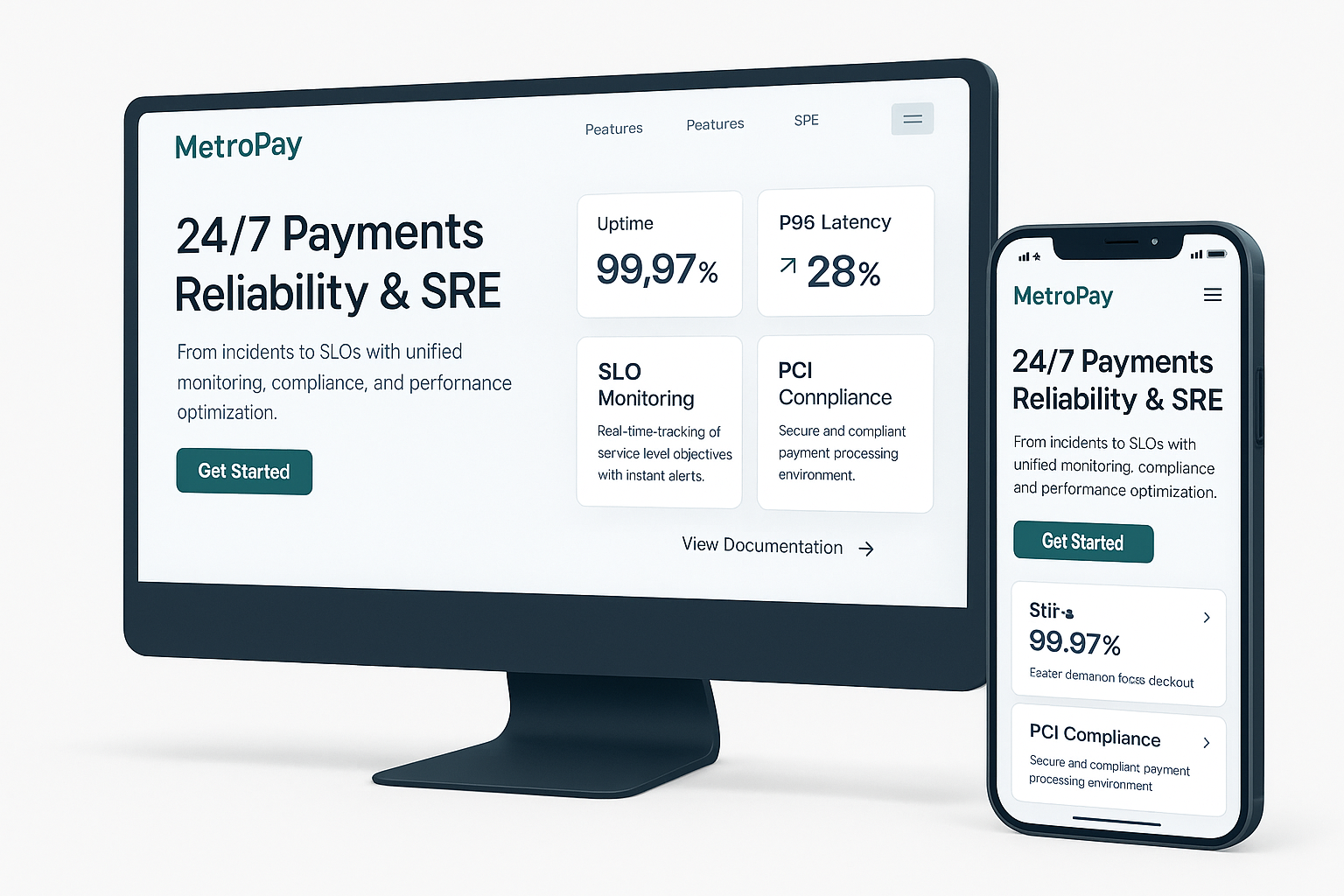

MetroPay — 24/7 Payments Reliability & SRE

A 24/7 managed reliability program that moved MetroPay from reactive firefighting to SLO-driven operations with airtight observability, faster recoveries, and audit-ready security.

SCOPE

What We Did

Unified Observability & SLOs

Implemented Datadog APM, metrics, logs, and synthetics with service-level objectives and error budgets across payment APIs and checkout flows.

Incident Response & On-Call

Designed escalation paths, runbooks, and on-call rotations; automated paging and post-incident RCAs with action tracking.

Security & Patching

Monthly patch cycles, vulnerability scanning, hardened images, secrets management, and compliance evidence collection.

Backups & Disaster Recovery

Automated daily backups, quarterly restore tests, and DR playbooks achieving RPO ≈15 min / RTO ≈1 hr.

CI/CD & Release Engineering

GitHub Actions pipelines with canary releases, progressive rollouts, and automated rollbacks to reduce change failure rate.

Performance & Cost Tuning

Kubernetes HPA tuning, NGINX optimizations, connection pooling, and cache strategies for predictable peak performance.

Outcomes Delivered

Uptime 99.97% across critical payment services

P95 latency ↓28% on payment APIs

MTTD ↓65% and MTTR ↓45% with runbooked responses

Change failure rate ↓40% via canary + automated rollback

Passed PCI-DSS audit with automated evidence collection

BRIEF

MetroPay processes high-volume card transactions with strict SLAs and seasonal peaks.

They needed round-the-clock coverage, measurable reliability, and compliance without slowing product delivery.

CHALLENGE

Fragmented monitoring and alert fatigue led to slow detection and inconsistent incident handling.

Peak-time degradations and risky deploys increased cart abandonment and chargeback exposure.

Compliance burden (PCI-DSS) required auditable controls, secure pipeline, and evidence automation.

From incidents to SLOs: a reliability operating model

OBSERVABILITY & SLOS

Mapped golden signals, added distributed tracing, and defined SLOs (availability, latency) with error budgets and dashboard drill-downs.

INCIDENT RESPONSE

Built runbooks, on-call rotations, and graded severities; automated paging, status updates, and post-incident RCAs with owners and due dates.

SECURITY & COMPLIANCE

Hardened containers, managed secrets, monthly patch/vuln cycles, and audit trails—exported as evidence bundles for PCI controls.

RELEASE SAFETY

CI/CD with canary and progressive delivery, health-based promotions, and one-click rollback to reduce change failure rate.

Key results & impact

The comprehensive strategy delivered exceptional results across all key performance indicators, positioning MetroPay as a leader in its market.

Service Uptime

SLO-aligned operations and HA architecture ensured near-continuous availability.

P95 Latency

NGINX + API optimizations and autoscaling improved payment responsiveness.

MTTD / MTTR

Unified alerts and runbooks cut detection and recovery times substantially.

PCI-DSS Pass

Compliance evidence automated from monitoring, CI/CD, and access logs.

Always-On, Audit-Ready, Peak-Proof

With proactive monitoring, disciplined incident management, and safer releases, MetroPay ships faster while meeting stringent uptime and compliance targets.